1. Wealth Management

“The consultative process of meeting the needs and wants of affluent individuals by providing the appropriate financial products and services.”

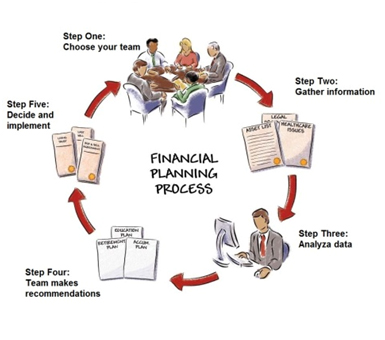

While it is common for you to be sitting with a wealth advisor to address a particular need (investment management, insurance, estate), the consultative wealth advisor overriding objective is to understand you and find out what is important and why. The wealth advisor is able to bring the appropriate experts and provide you with the appropriate solution.

2. Investment Management:

• Fee base discretionary portfolio management

• Separately managed accounts

• Fiduciary duty, portfolio managers acting in your best interest.

• Income driven portfolios.

3. Risk Management:

• Estate protection

• Insurance

• Creditor protection

4. Tax Planning:

• Minimizing taxes

• Tax advantage income distribution.

• Tax free savings

• Incorporation options